Property Tax Ottawa Reddit . Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. It’s property tax time and l was wondering on the issue of assessments. property tax is based on assessed property value and mpac does not update instantly to reflect real time property values. explanation of property tax calculations. Schedule 3, on the reverse side of your capped property tax bill, summarizes how. an online tool by the city of ottawa that provides residents with the ability to look up a property's tax and assessment. property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments paying the property tax. included in the city of ottawa's 2023 tax breakdown are these types of properties:

from storeys.com

Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments property tax is based on assessed property value and mpac does not update instantly to reflect real time property values. Schedule 3, on the reverse side of your capped property tax bill, summarizes how. property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. paying the property tax. explanation of property tax calculations. included in the city of ottawa's 2023 tax breakdown are these types of properties: It’s property tax time and l was wondering on the issue of assessments. an online tool by the city of ottawa that provides residents with the ability to look up a property's tax and assessment.

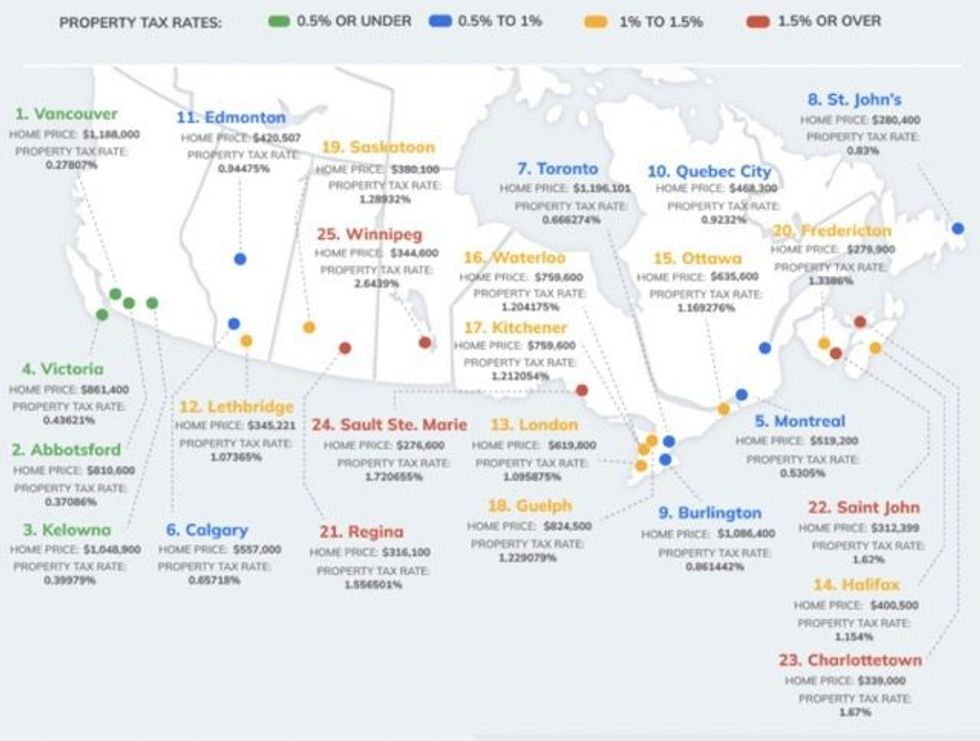

Canadian Cities With The Highest And Lowest Property Tax Rates

Property Tax Ottawa Reddit property tax is based on assessed property value and mpac does not update instantly to reflect real time property values. Schedule 3, on the reverse side of your capped property tax bill, summarizes how. property tax is based on assessed property value and mpac does not update instantly to reflect real time property values. included in the city of ottawa's 2023 tax breakdown are these types of properties: It’s property tax time and l was wondering on the issue of assessments. property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. explanation of property tax calculations. Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. paying the property tax. an online tool by the city of ottawa that provides residents with the ability to look up a property's tax and assessment. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments

From www.mtpr.org

Property taxes, explained — with pictures Montana Public Radio Property Tax Ottawa Reddit It’s property tax time and l was wondering on the issue of assessments. property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments an online tool by the city of ottawa that provides residents with the ability. Property Tax Ottawa Reddit.

From globalnews.ca

COVID19 Ottawa small business property tax cut proposed for 2022 Property Tax Ottawa Reddit Schedule 3, on the reverse side of your capped property tax bill, summarizes how. explanation of property tax calculations. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments included in the city of ottawa's 2023 tax breakdown are these types of properties: property taxes in ottawa are calculated based on the assessed value of. Property Tax Ottawa Reddit.

From alizadowney.blogspot.com

the tax place ottawa Aliza Downey Property Tax Ottawa Reddit property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments Schedule 3, on the reverse side of your capped property tax bill, summarizes how. explanation of property tax calculations. It’s property tax time and l was wondering. Property Tax Ottawa Reddit.

From www.youtube.com

Ottawa Vacant Unit Tax (VUT) What You Need to Know YouTube Property Tax Ottawa Reddit It’s property tax time and l was wondering on the issue of assessments. property tax is based on assessed property value and mpac does not update instantly to reflect real time property values. property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. included in the city of. Property Tax Ottawa Reddit.

From blnnews.com

Property Taxes Due today BlnNews Property Tax Ottawa Reddit paying the property tax. It’s property tax time and l was wondering on the issue of assessments. explanation of property tax calculations. Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. property taxes in ottawa are calculated based on the assessed value of your property and the city's. Property Tax Ottawa Reddit.

From www.newsncr.com

These States Have the Highest Property Tax Rates Property Tax Ottawa Reddit Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. explanation of property tax calculations. paying the property tax. property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. Schedule 3, on the reverse side of your capped property tax. Property Tax Ottawa Reddit.

From whiteluxuryhomes.com

Property Tax Deductions What You Need to Know! White Luxury Homes Property Tax Ottawa Reddit Schedule 3, on the reverse side of your capped property tax bill, summarizes how. paying the property tax. Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. included in the city of ottawa's 2023 tax breakdown are these types of properties: posted in r/ottawa by u/ricopapaya • 132. Property Tax Ottawa Reddit.

From comoxmortgages.com

Property Tax Notice (Statement) Mackenzie Gartside & Associates Property Tax Ottawa Reddit paying the property tax. explanation of property tax calculations. It’s property tax time and l was wondering on the issue of assessments. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments Schedule 3, on the reverse side of your capped property tax bill, summarizes how. Paymentus charges a high fee (1.99%) when you pay your. Property Tax Ottawa Reddit.

From www.newpurveyors.com

A Comprehensive Guide to Property Taxes in Ottawa — New Purveyors Property Tax Ottawa Reddit explanation of property tax calculations. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments included in the city of ottawa's 2023 tax breakdown are these types of properties: Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. It’s property tax time and l was wondering on. Property Tax Ottawa Reddit.

From www.alpharetta.ga.us

Property Tax Bills Mailed To Residents Property Tax Ottawa Reddit property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. Schedule 3, on the reverse side of your capped property tax bill, summarizes how. explanation of property tax calculations. an online tool by the city of ottawa that provides residents with the ability to look up a property's. Property Tax Ottawa Reddit.

From www.youtube.com

Ottawa's Vacant Unit Tax YouTube Property Tax Ottawa Reddit posted in r/ottawa by u/ricopapaya • 132 points and 107 comments property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. explanation of property tax calculations. an online tool by the city of ottawa that provides residents with the ability to look up a property's tax and. Property Tax Ottawa Reddit.

From www.youtube.com

How to complete the Vacant Unit Tax declaration YouTube Property Tax Ottawa Reddit an online tool by the city of ottawa that provides residents with the ability to look up a property's tax and assessment. Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. property tax is based on assessed property value and mpac does not update instantly to reflect real time. Property Tax Ottawa Reddit.

From www.mlive.com

Ottawa County property taxes expected to go up at highest rate in 30 Property Tax Ottawa Reddit explanation of property tax calculations. Schedule 3, on the reverse side of your capped property tax bill, summarizes how. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments included in the city of ottawa's 2023 tax breakdown are these types of properties: paying the property tax. It’s property tax time and l was wondering. Property Tax Ottawa Reddit.

From www.ctrg-tax.net

ottawa property tax bill Canadian Tax Resource Group Property Tax Ottawa Reddit Schedule 3, on the reverse side of your capped property tax bill, summarizes how. property tax is based on assessed property value and mpac does not update instantly to reflect real time property values. explanation of property tax calculations. property taxes in ottawa are calculated based on the assessed value of your property and the city's tax. Property Tax Ottawa Reddit.

From www.ottawalife.com

A 2.5 Increase in Ottawa Property Taxes is Approved by Council Property Tax Ottawa Reddit Schedule 3, on the reverse side of your capped property tax bill, summarizes how. explanation of property tax calculations. paying the property tax. It’s property tax time and l was wondering on the issue of assessments. posted in r/ottawa by u/ricopapaya • 132 points and 107 comments property taxes in ottawa are calculated based on the. Property Tax Ottawa Reddit.

From premierottawa.ca

Everything You Need to Know About Property Taxes in Ottawa PREMIER Ottawa Property Tax Ottawa Reddit property taxes in ottawa are calculated based on the assessed value of your property and the city's tax rate. It’s property tax time and l was wondering on the issue of assessments. included in the city of ottawa's 2023 tax breakdown are these types of properties: property tax is based on assessed property value and mpac does. Property Tax Ottawa Reddit.

From www.popular.pics

Don't about filing for property tax exemptions if you qualify Property Tax Ottawa Reddit property tax is based on assessed property value and mpac does not update instantly to reflect real time property values. Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. explanation of property tax calculations. included in the city of ottawa's 2023 tax breakdown are these types of properties:. Property Tax Ottawa Reddit.

From ottawa.ctvnews.ca

Ottawa City Hall Council votes to maintain vacant unit tax on empty Property Tax Ottawa Reddit posted in r/ottawa by u/ricopapaya • 132 points and 107 comments an online tool by the city of ottawa that provides residents with the ability to look up a property's tax and assessment. Paymentus charges a high fee (1.99%) when you pay your property tax bill using a credit card, or. Schedule 3, on the reverse side of. Property Tax Ottawa Reddit.